Understanding Cyber Liability Insurance Coverage Protecting Your Business from Cyber Threats

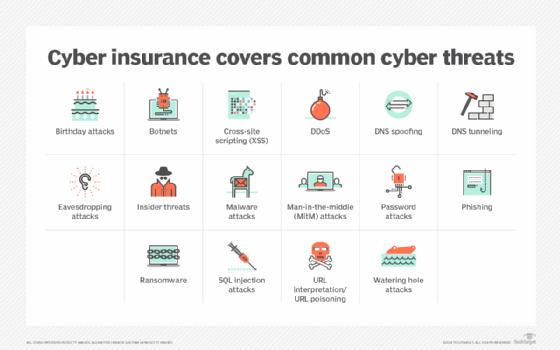

Explore the essentials of cyber liability insurance coverage and how it can protect your business from the growing risk of cyber threats. Safeguard your company from data breaches and cyberattacks.

In today's digital age, businesses face increasing risks from cyber threats that can lead to severe financial and reputational damage. Cyber liability insurance has become an essential safeguard for companies looking to protect themselves from the financial consequences of data breaches, cyber-attacks, and other online risks. This article will explore the key components of cyber liability insurance coverage, common policy features, coverage limits, and the benefits of having this crucial insurance.

Key Components of Cyber Liability Insurance Coverage

Cyber liability insurance is designed to provide coverage for a variety of cyber risks and incidents. Here are the core components of this insurance

1. Data Breach Coverage

This component covers the costs associated with a data breach, including notification costs, credit monitoring for affected individuals, and legal expenses. For businesses in cities like Louisville and Grand Rapids, where the regulatory landscape might vary, this coverage ensures compliance with state and federal laws.

2. Network Security Coverage

Network security coverage protects against incidents that compromise the integrity of your network, such as hacking, malware, or denial-of-service attacks. This coverage includes costs related to restoring your network and systems, and addressing any resulting downtime.

3. Business Interruption Coverage

If a cyber incident disrupts your business operations, business interruption coverage compensates for lost income and extra expenses incurred to keep the business running. This is crucial for companies in Oklahoma City and Des Moines where downtime can significantly impact revenue.

4. Errors and Omissions Coverage

This coverage applies if your business is sued for negligence related to the performance of your services or products. For example, if a client claims that a software flaw led to a security breach, this component helps cover the legal and settlement costs.

5. Cyber Extortion Coverage

Cyber extortion coverage addresses the costs related to ransomware attacks or other forms of extortion. This includes the ransom payments and any associated negotiation costs. Businesses in Lansing can benefit from this coverage as extortion threats are increasingly common.

6. Legal and Regulatory Costs

In the event of a data breach or cyber-attack, there can be significant legal and regulatory costs. This component of cyber liability insurance covers expenses related to legal defense, regulatory fines, and penalties.

Common Policy Features

When selecting a cyber liability insurance policy, businesses should be aware of the following features

1. Coverage Limits

Coverage limits determine the maximum amount the insurance will pay for a covered claim. Policies typically have separate limits for different types of coverage, such as data breach costs and business interruption. It's important for businesses in Grand Rapids and Louisville to assess their potential risk exposure and choose limits that adequately cover their needs.

2. Deductibles

Policies often include deductibles, which are the amounts you must pay out of pocket before the insurance coverage kicks in. Lower deductibles can mean higher premiums but may be worth it for businesses with higher risk exposure.

3. Exclusions

It's crucial to understand what is not covered by your policy. Common exclusions might include coverage for pre-existing vulnerabilities or cyber incidents caused by employee negligence. Businesses in Oklahoma City should carefully review exclusions to ensure they are not leaving gaps in their coverage.

4. Incident Response Services

Many cyber liability insurance policies offer access to incident response teams, which provide immediate assistance in the event of a cyber incident. These services can include forensic analysis, public relations support, and legal advice.

5. Coverage for Third-Party Claims

This feature covers claims made by third parties affected by a data breach or cyber-attack. It includes coverage for legal costs, settlements, and judgments arising from such claims.

Coverage Limits and Benefits

1. Coverage Limits

Coverage limits for cyber liability insurance can vary widely depending on the policy and the insurer. Typical limits range from $1 million to $10 million, but businesses with higher risk profiles might need more substantial coverage. For businesses in Des Moines and Lansing, assessing the potential financial impact of a cyber incident is key to selecting appropriate coverage limits.

2. Benefits of Cyber Liability Insurance

- Financial Protection It helps cover the costs associated with cyber incidents, reducing the financial burden on your business.

- Legal Compliance Ensures compliance with data protection regulations, helping you avoid hefty fines and penalties.

- Reputation Management Provides resources to manage public relations and restore your business's reputation following a cyber incident.

- Operational Continuity Assists in minimizing downtime and maintaining business operations during and after a cyber event.

Cyber liability insurance is a critical component of a comprehensive risk management strategy for businesses in today's digital landscape. By understanding the key components, common policy features, and the benefits of this insurance, businesses can better protect themselves from the financial and operational impacts of cyber threats. Whether you're a small business in Louisville or a larger enterprise in Grand Rapids, investing in robust cyber liability insurance can provide peace of mind and a safeguard against the growing risk of cyber incidents.

Top Cyber Liability Insurance Providers A Comprehensive Comparison

In today’s digital landscape, cyber liability insurance has become a crucial component for businesses of all sizes. Whether you're a small startup or a large enterprise, safeguarding your business against cyber threats is essential. This article compares the top cyber liability insurance providers, exploring their coverage options, pricing, and unique features to help you choose the best provider for your needs.

1. Understanding Cyber Liability Insurance

Cyber liability insurance protects businesses from financial losses due to cyberattacks and data breaches. It covers various aspects, including

- Data Breach Costs Expenses related to notification, credit monitoring, and legal fees.

- Business Interruption Loss of income during a cyber incident.

- Cyber Extortion Costs associated with ransomware attacks.

- Legal Costs Expenses for defending against lawsuits resulting from data breaches.

2. Comparing Top Cyber Liability Insurance Providers

A. Provider A SecureGuard Insurance

Coverage Options

- Data Breach Response Comprehensive coverage for notification, credit monitoring, and crisis management.

- Business Interruption Coverage for income loss due to a cyber event.

- Cyber Extortion Protection against ransomware attacks.

Pricing

- Offers competitive pricing with tiered packages based on business size and industry.

Unique Features

- 24/7 cybersecurity hotline.

- Access to a network of cybersecurity experts for immediate assistance.

Best Suited For

- Small startups and medium-sized businesses looking for affordable and comprehensive coverage.

B. Provider B CyberShield Solutions

Coverage Options

- Data Breach Costs Extensive coverage including legal defense and regulatory fines.

- Business Interruption High limits for income loss and operational disruption.

- Cyber Extortion Includes coverage for both ransom payments and negotiation costs.

Pricing

- Higher pricing due to extensive coverage options but provides customizable plans based on business needs.

Unique Features

- Includes cybersecurity training for employees.

- Offers a robust risk management program.

Best Suited For

- Large enterprises with complex cybersecurity needs and higher risk exposure.

C. Provider C SafeNet Insurance

Coverage Options

- Data Breach Response Standard coverage with options for additional riders.

- Business Interruption Coverage tailored to various industry needs.

- Cyber Extortion Basic coverage with optional enhancements.

Pricing

- Budget-friendly with a range of plans suitable for different business sizes.

Unique Features

- User-friendly online portal for policy management and claims.

- Focus on small business needs with flexible policy options.

Best Suited For

- Small businesses and freelancers looking for cost-effective solutions.

D. Provider D DefendIT Insurance

Coverage Options

- Data Breach Costs Comprehensive coverage including global compliance.

- Business Interruption High limits with options for increased coverage.

- Cyber Extortion Includes full ransom coverage and expert negotiation support.

Pricing

- Premium pricing reflects extensive coverage and high limits.

Unique Features

- International coverage for global operations.

- Advanced threat intelligence and monitoring services.

Best Suited For

- Large enterprises with global operations and high-risk profiles.

3. Choosing the Right Provider for Your Business

When selecting a cyber liability insurance provider, consider the following factors

- Business Size Smaller businesses may find more value in providers offering budget-friendly plans with essential coverage, while larger enterprises might need comprehensive solutions with higher limits.

- Industry Needs Some industries face higher cyber risks and require specialized coverage. Ensure the provider understands your industry-specific needs.

- Coverage Options Assess the coverage options and limits provided by each provider to ensure they align with your business's risk profile.

- Pricing Evaluate the cost of coverage relative to the protection offered. Consider whether a higher premium might be justified by extensive coverage and unique features.

4. Key Considerations for Different Types of Businesses

- Small Startups Look for providers offering cyber liability insurance for small business with affordable pricing and essential coverage options. Provider C and Provider A are well-suited for startups.

- Medium-Sized Businesses Opt for providers that offer a balance between coverage and cost. Provider A and Provider B provide scalable solutions.

- Large Enterprises Choose providers with extensive coverage, high limits, and additional features like international coverage. Provider B and Provider D are ideal for large enterprises.

Selecting the right cyber liability insurance provider is critical for protecting your business against cyber threats. By comparing the top providers and understanding their coverage options, pricing, and unique features, you can make an informed decision that aligns with your business needs. Whether you're in Louisville, Grand Rapids, Oklahoma City, Lansing, or Des Moines, securing the right coverage will help safeguard your business's digital assets and ensure resilience against cyber risks.

Why Your Business Needs Cyber Liability Insurance Coverage

In today’s digital landscape, the question isn't if your business will face a cyberattack, but when. As technology advances, so do the tactics of cybercriminals. Businesses of all sizes are vulnerable to cyber threats, and the financial and reputational damage from a breach can be devastating. This is where cyber liability insurance coverage becomes crucial. Here’s why every business, whether in Louisville, Grand Rapids, Oklahoma City, Lansing, or Des Moines, needs this essential protection.

The Growing Threat of Cyberattacks

Cyberattacks are no longer a distant concern for IT departments; they are a pressing issue affecting businesses worldwide. The rise of ransomware, phishing schemes, and data breaches highlights the urgent need for robust cyber liability insurance coverage. Here’s why

-

Increasing Frequency of Attacks Cyberattacks have surged in frequency. From large corporations to small businesses, no one is immune. In 2023 alone, over 50% of small to medium-sized businesses reported experiencing some form of cyberattack.

-

Sophistication of Cybercriminals Today’s cybercriminals are highly skilled and employ advanced tactics to breach security systems. Their methods are continuously evolving, making it challenging for businesses to keep up with defense measures.

-

High Costs of Breaches The financial repercussions of a cyberattack can be severe. The average cost of a data breach in the U.S. was approximately $4.45 million in 2023. Costs can include legal fees, notification expenses, regulatory fines, and the loss of customer trust.

Financial Consequences of Cyberattacks

Understanding the potential financial impacts of a cyberattack can underscore the importance of having cyber liability insurance coverage

-

Data Breach Costs The immediate costs following a data breach include forensic investigations, data recovery, and customer notifications. These expenses can quickly add up, especially for businesses handling large volumes of sensitive data.

-

Regulatory Fines and Penalties Businesses are subject to various regulations, such as the GDPR and CCPA, which impose strict data protection standards. Non-compliance can result in hefty fines and penalties, further straining your finances.

-

Legal Fees In the aftermath of a cyberattack, businesses may face lawsuits from affected parties, including customers and partners. Legal fees and settlements can be substantial, especially if the case involves negligence claims.

-

Reputation Damage The reputational damage from a cyberattack can have long-term effects on your business. Loss of customer trust can lead to decreased revenue and difficulty in acquiring new clients.

-

Operational Disruption Cyberattacks can disrupt your business operations, leading to downtime and productivity losses. This can affect your bottom line and hinder your ability to serve your customers effectively.

How Cyber Liability Insurance Coverage Can Help

Investing in cyber liability insurance coverage can significantly mitigate the risks associated with cyber threats. Here’s how

-

Financial Protection Cyber liability insurance covers various costs associated with a data breach, including forensic investigations, legal fees, and regulatory fines. This can help protect your business from the high financial impacts of an attack.

-

Incident Response Support Many policies include access to expert incident response teams who can assist with managing and mitigating the damage from a cyberattack. This support can be invaluable in navigating the complexities of a breach.

-

Legal Defense and Settlements Coverage often includes legal defense costs and settlement payments in the event of lawsuits related to data breaches or privacy violations.

-

Regulatory Compliance Assistance Cyber liability insurance can provide guidance on complying with data protection regulations and handling regulatory inquiries, reducing the risk of costly fines.

-

Reputation Management Some policies offer resources for public relations and reputation management to help businesses recover from the damage to their brand following a cyber incident.

Choosing the Right Cyber Liability Insurance Policy

When selecting a cyber liability insurance policy, consider the following factors to ensure you get the coverage that meets your business needs

-

Coverage Limits Assess the coverage limits offered by different policies and ensure they are sufficient to address potential risks. This includes protection for various types of breaches, such as data theft and ransomware attacks.

-

Exclusions Review policy exclusions to understand what is not covered. This will help you avoid unexpected gaps in coverage and ensure that critical risks are addressed.

-

Additional Features Look for policies that offer additional features, such as risk management services, cyber risk assessments, and access to legal and IT experts.

-

Cost Compare the cost of different policies, but also consider the value of the coverage provided. Opting for the cheapest policy may not always provide the protection you need.

-

Provider Reputation Research the reputation of insurance providers and their experience in handling cyber liability claims. Choose a provider with a track record of effective claims management and customer support.

In an era where cyber threats are increasingly common and sophisticated, cyber liability insurance coverage is not just an option but a necessity for businesses. The potential financial and reputational consequences of a cyberattack underscore the importance of having the right insurance in place. By investing in cyber liability insurance, businesses in Louisville, Grand Rapids, Oklahoma City, Lansing, and Des Moines can protect themselves against the unpredictable and often devastating effects of cyber incidents. Ensure your business is prepared by choosing a comprehensive policy that offers the protection you need to navigate the digital landscape safely.

Cyber Liability Insurance Coverage for E-commerce Businesses

As e-commerce continues to surge in popularity, businesses operating online face unique risks that require specialized insurance coverage. Cyber liability insurance is crucial for e-commerce businesses to safeguard against the increasing threat of cyber incidents. This article explores the specific coverage needs for e-commerce businesses, including protection against data breaches, online fraud, and safeguarding customer information.

Understanding Cyber Liability Insurance

Cyber liability insurance is designed to protect businesses from the financial repercussions of cyberattacks and data breaches. For e-commerce businesses, which handle sensitive customer information and conduct transactions online, having robust cyber liability coverage is essential.

Coverage Needs for E-commerce Businesses

1. Data Breach Coverage

One of the primary risks for e-commerce businesses is a data breach. Such incidents can expose sensitive customer data, including payment information, personal identification, and more. This type of coverage typically includes

- Notification Costs Expenses related to informing affected individuals about the breach.

- Credit Monitoring Services provided to affected individuals to monitor their credit and identity.

- Legal Costs Legal expenses incurred from defending against lawsuits or regulatory actions related to the breach.

- Forensic Investigation Costs associated with investigating the breach to determine its origin and impact.

2. Online Fraud Protection

E-commerce businesses are prime targets for online fraud, including phishing scams, account takeover, and fraudulent transactions. Coverage for online fraud can include

- Financial Loss Reimbursement for losses resulting from fraudulent transactions or scams.

- Fraud Investigation Costs related to investigating fraudulent activities.

- Recovery Costs Expenses associated with recovering lost funds and restoring affected systems.

3. Customer Information Protection

Protecting customer information is paramount for e-commerce businesses. Coverage related to customer information protection includes

- Data Recovery Costs involved in restoring or recovering lost or corrupted data.

- Breach Response Assistance with managing the response to a data breach, including public relations and crisis management.

- Regulatory Fines Coverage for fines and penalties imposed by regulatory bodies for failing to protect customer data.

Additional Coverage Considerations

In addition to the core coverages mentioned, e-commerce businesses should consider the following additional protections

Professional Liability Insurance

For businesses offering professional services online, professional liability insurance (also known as errors and omissions liability insurance) can protect against claims of negligence or mistakes.

General Liability Insurance

While general liability insurance may not cover cyber incidents, it is essential for protecting against other risks such as bodily injury or property damage. It’s important for e-commerce businesses to have this coverage in place as a complementary safeguard.

Commercial Umbrella Liability Insurance

For enhanced protection beyond standard policies, commercial umbrella liability insurance can provide additional coverage limits for various liabilities, including those not covered by primary cyber liability policies.

Employment Practices Liability Insurance

Employment practices liability insurance can be crucial for e-commerce businesses with employees, covering claims related to wrongful termination, discrimination, or harassment.

Comparing Insurance Providers

When selecting a cyber liability insurance provider, consider factors such as coverage limits, exclusions, and the insurer's reputation. Look for providers that offer comprehensive coverage tailored to the needs of e-commerce businesses. Additionally, compare business liability insurance options to ensure you have adequate protection across all risk areas.

Cyber Liability Insurance in Key Cities

The importance of cyber liability insurance is relevant across various locations. Here’s a brief overview of how coverage can be vital for e-commerce businesses in specific USA cities

- Louisville As a growing hub for businesses, Louisville's e-commerce sector requires robust cyber liability insurance to handle the unique risks of online transactions.

- Grand Rapids With its expanding tech industry, Grand Rapids businesses need to safeguard against cyber threats with comprehensive coverage.

- Oklahoma City E-commerce businesses in Oklahoma City should be aware of the potential risks and ensure they have adequate cyber liability insurance to mitigate these threats.

- Lansing In Lansing, e-commerce businesses can benefit from specialized insurance coverage to address both cyber risks and general business liabilities.

- Des Moines As e-commerce continues to grow in Des Moines, having strong cyber liability insurance is crucial for protecting against data breaches and online fraud.

For e-commerce businesses, cyber liability insurance is not just an option but a necessity. With the increasing prevalence of cyber threats, having comprehensive coverage for data breaches, online fraud, and customer information protection is essential. By understanding and addressing these specific coverage needs, e-commerce businesses can better protect themselves from the financial and reputational damage that cyber incidents can cause. Ensure you evaluate your insurance needs and choose the right coverage to safeguard your online operations effectively.

How to Choose the Best Cyber Liability Insurance Coverage A Comprehensive Guide

In today's digital age, businesses of all sizes are increasingly vulnerable to cyber threats. From data breaches to ransomware attacks, the risks associated with cyber incidents can have severe financial and reputational consequences. Cyber liability insurance coverage is crucial for protecting your business from these risks. This guide will walk you through how to select the best cyber liability insurance for your business, with tips on assessing your needs, comparing policies, and understanding terms and conditions.

Assessing Your Business's Specific Needs

Before diving into policy options, it’s essential to evaluate your business’s unique needs. Consider the following factors

1. Type of Business and Industry

Different industries face varying levels of cyber risk. For instance, ecommerce businesses handling sensitive customer information may require more extensive coverage than a local contractor. Similarly, healthcare professionals and consultants may face unique risks related to client data and confidentiality.

2. Size and Scope of Your Business

The size of your business can significantly impact your cyber liability needs. Larger businesses or those with extensive commercial auto liability insurance and general liability insurance for small business may need more comprehensive coverage compared to smaller businesses.

3. Data Sensitivity

If your business deals with sensitive data, such as product liability insurance cost or employment practices liability insurance cost, you will need coverage that specifically addresses the risk of data breaches and data loss.

4. Existing Cybersecurity Measures

Evaluate the strength of your current cybersecurity measures. Businesses with advanced cybersecurity systems may have different insurance needs compared to those with basic protections.

Comparing Different Policies

Once you’ve assessed your needs, it’s time to compare different cyber liability insurance coverage options. Here’s what to look for

1. Coverage Limits

Different policies offer varying coverage limits. Ensure that the coverage limits are adequate for your business’s size and the level of risk you face. Policies should cover costs related to

- Data breaches

- Business interruption

- Notification and credit monitoring services

- Legal expenses

2. Types of Coverage

Look for policies that include a broad range of coverages. Essential coverages to consider are

- Data Breach Response Covers the costs of managing a data breach, including notification and credit monitoring.

- Network Security Liability Provides coverage for damages resulting from a security breach.

- Errors and Omissions Liability Covers claims related to the failure of your business to perform professional duties.

3. Exclusions

Carefully review the policy exclusions. Common exclusions may include

- Pollution liability insurance coverage Typically not covered by cyber liability policies.

- Product liability insurance for ecommerce Ensure this is included if your business involves selling products online.

- Directors and officers liability insurance cost Check if this is covered or needs a separate policy.

4. Policy Endorsements

Check if the policy offers endorsements or additional coverage options. Endorsements can tailor the policy to your specific needs, such as adding coverage for commercial general liability insurance or errors and omissions liability insurance.

Understanding Terms and Conditions

It’s crucial to fully understand the terms and conditions of any cyber liability insurance policy before purchasing. Focus on the following areas

1. Deductibles and Premiums

Understand the deductibles and premiums associated with the policy. A higher deductible might lower your premium but increase your out-of-pocket costs in the event of a claim.

2. Claims Process

Review the claims process outlined in the policy. Ensure it is straightforward and that you understand the steps required to file a claim.

3. Coverage for Third-Party Claims

Many policies cover third-party claims related to data breaches or cyberattacks. Ensure that your policy includes this coverage and understand any limitations.

4. Legal and Regulatory Compliance

Check if the policy covers legal fees and fines related to regulatory compliance issues, such as GDPR or CCPA. This is particularly important if your business operates in multiple states or countries.

Top Tips for Selecting the Best Cyber Liability Insurance

1. Consult with an Insurance Professional

Work with an insurance broker or advisor who specializes in cyber liability insurance coverage. They can help you navigate the complexities of different policies and find the best fit for your business.

2. Compare Multiple Quotes

Don’t settle for the first quote you receive. Compare quotes from multiple providers to ensure you’re getting the best coverage for the cost. Consider business liability insurance comparison tools to streamline this process.

3. Review Customer Reviews

Look into customer reviews and ratings of insurance providers. This can provide insights into their claims handling process and customer service.

4. Consider Future Needs

As your business grows, your cyber liability needs may change. Choose a policy that offers flexibility or the option to adjust coverage as needed.

Choosing the right cyber liability insurance coverage is a critical step in protecting your business from the growing threat of cyberattacks. By assessing your specific needs, comparing different policies, and thoroughly understanding the terms and conditions, you can make an informed decision that safeguards your business’s financial and reputational health.

What's Your Reaction?